A long-term commitment to lean at American Family Insurance

INTERVIEW – With a long history of improvement efforts and a commitment to giving divisions the time to really grasp lean thinking, American Family Insurance is laying the foundation for real and lasting change.

Interviewee: Matt Cornwell, Lean Customer Value Associate Vice President, American Family Insurance - Madison, Wisconsin, USA.

Roberto Priolo: When did your lean journey start?

Matt Cornwell: We have had process improvement and quality efforts at American Family Insurance for over 25 years.They have generally been localized divisional efforts or smaller centralized efforts, and have had more of a TQM or six sigma feel. I think these efforts were really important in that they planted seeds for today’s progress by creating advocates for continuous improvement across the company. We also learned a great deal from both successes and failures, and we were able to incorporate that learning into our current model. Our lean transformation has been underway for four years now. I think what makes it different is the organizational breadth of the effort, the alignment with our enterprise strategy and mission (which is squarely focused on our customers), and the commitment of our senior leaders to use lean to transform our culture to one that is faster and more agile through empowerment, collaboration, and experimentation.

RP: What are the principles behind the American Family Lean System? How did you design it?

MC: At the highest level, there is nothing in there that is particularly mysterious or unrecognizable to the “lean eye”. The system includes the most fundamental lean principles and tools you expect to see in a lean organization, such as visual management, KPIs, standard work for employees and leaders, and continuous improvement. What I think has been most important was to customize the details of the system, our rollout strategy, and the principles behind the system to fit American Family’s strategy and culture. We did so by co-creating the system with our team of lean coaches. Because they would be responsible for helping the organization implement it, we wanted them to have a lot of input into the design and feel ownership of it. We put a big emphasis on the lean principles and their alignment to our company values, and we try to be flexible in meeting the unique needs in each part of our business – rather than implementing a rigid approach focused on tools.

RP: What are the challenges of using lean thinking in an insurance company?

MC: I joined American Family 13 years ago, and before that I was an Industrial Engineer and a six sigma Black Belt. When I joined the company I had concerns about how applicable my skillset in continuous improvement and lean tools would be, but I was pleasantly surprised by how well the principles translated. There are some differences I noticed right away: in manufacturing, I was used to kaizen events in which we could change the layout of the assembly line overnight, but often that’s just not possible in an insurance company. In many cases there is too much risk associated with changing a process that quickly without testing it first, because activities are often very interconnected both between different parts of the company and different technology systems. We have less reliance on things like 5S or SMED than I did in a setting with physical products, but the principles are still highly relevant – they just need a translation and some tweaks in how you use them. A lot of it is the same, and in many cases I have found lean to be even more effective in settings like ours where WIP, defects, and rework can be invisible.

RP: Looking back and reflecting on the journey, how would you say it evolved?

MC: We have what I believe is a fairly unique model for deploying lean. We have a centralized team of lean employee-coaches who are assigned to support specific parts of the organization. Since we are trying to build people capability around a system, in addition to improving processes, we make this commitment for a significant amount of time – at least five years for each division. This is a level of commitment to developing our people and improving our business that I have not seen many companies make. In addition to all the business benefits we are getting through lean itself, it is evolving to serve as a platform of tools and behaviors that can be used for other types of transformations as well, most notably our digital transformation.

RP: How much of the organization has lean reached so far?

MC: We rolled lean out in two waves, which really correspond to the two major milestones in our lean journey. The first five divisions to begin adopting lean thinking were our proof of concept, which showed that our lean model would work and was scalable. This gave us a chance to experiment with the model and make adjustments. We work on a pull model, and directed these first engagements to areas of the company that were excited to be early adopters of lean. So, in the first wave we got to test our model in some operational areas as well as some non-production environments, such as product management groups and legal teams.

The second wave has been larger as we reach the rest of the company. This is important because it will enable divisions to better connect with each other in the value streams they share. Under the American Family brand, we have more than 95% of our 8,000+ employees involved in the lean transformation, and we are beginning to work with other companies in our enterprise with our deployment at The General®. About half of their employees have begun their lean journey.

RP: How is the role of the Lean Office changing over time?

MC: Our deployments generally start with training on things like gemba walks, boards, and huddles. As people become more engaged and start to gain more maturity in their lean capabilities, however, our role as lean facilitators pivots, becoming more coaching-intensive and less focused on training. Our senior executives are also getting more involved in our lean deployments and engaging with the front lines using lean tools – it’s been great. It changes our role a bit – still coaching, but sometimes with additional levels of the organization now. Ultimately, we would like to be able to slowly back away our support and have the system self-sustain with less outside help required.

RP: Can you give me some examples of improvements?

MC: We set out to drive cultural change and have it lead to better business results and strategy execution. One of my favorite examples of how much our culture has changed is our approach to problems. When I started at American Family 13 years ago, it was hard for us to talk about problems: we had project stoplights, but they had expanded from just red, yellow, and green to several additional colors – most of them different shades of green. It was our way to safely raise problems, but we were not very comfortable turning things yellow or red. I love that I can walk in the halls now and immediately see red all over the walls on huddle boards, because it means we are embracing our problems as opportunities to improve.

Our inbound call centers have done a lot of good work using lean. They get calls from customers looking to buy new insurance policies or make changes to their existing insurance. They made significant improvements in speed to answer, resulting in the lowest abandoned call rate in the history of the team. On the financial side, teams across the company have used lean principles to impact our gain from operations by over $40 million, money that can now be used to make things better for our customers.

Another improvement I love to talk about is what happened with our biggest operations group – issuing and underwriting home and auto policies – which we do in three large centers that are all embracing lean and working together. They were able to increase the number of ideas submitted by front-line staff by 300% in four years. At the same time, they decreased the amount of time needed to implement the ideas by 85%. The leaders are empowering their people and investing in them, to build new capabilities.

I could go on all day, because a lot of amazing things have happened! These are just some my favorites.

RP: How important was communication to engaging such a large number of people?

MC: Incredibly important. In general, our approach was to be very focused on the employees and front-line managers – those closest to the problems. Take our intranet articles: they are still an important tool for leaders to communicate with the company, but we are increasingly using it for front-line employees and managers to share their stories. This shift in how we communicate helps to reinforce and encourage the shift in our culture. Peer-to-peer communication proved very important for our lean program, reinforcing that lean is safe (there were concerns at first), and regularly sharing articles on our lean journey shows people efforts are ongoing and paying off. We have leveraged everything, from blogs to employee video hosting site (think internal YouTube) and an intranet system. Social media platforms like Twitter and LinkedIn have also been important peer-to-peer communications channels for our lean journey.

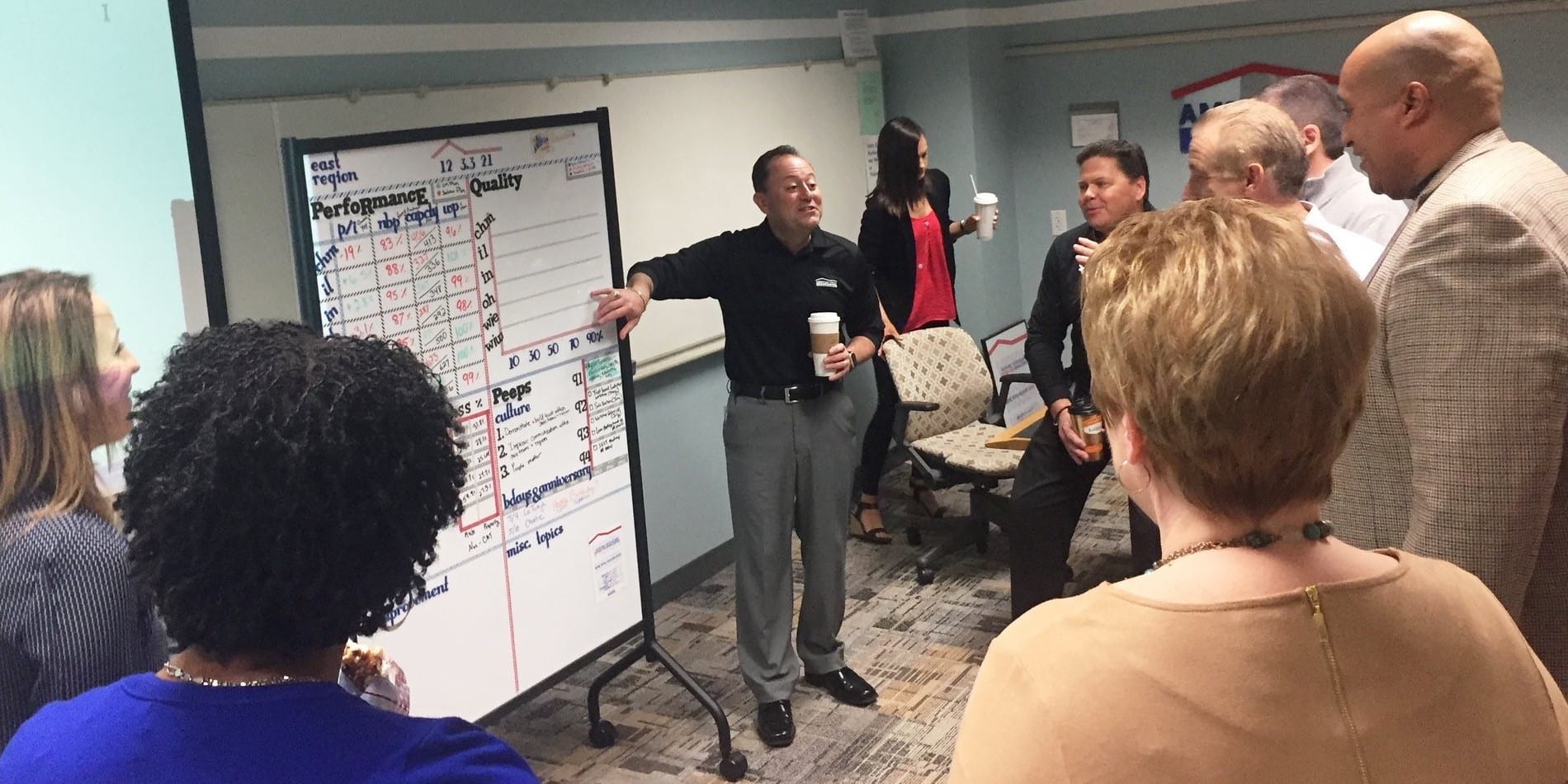

RP: Your visual management looks very fun, with a lot of colors, drawings and engaging images. What was your approach to that?

MC: We always say that if you are not having fun with lean, you probably aren’t doing it right. We start out by training on five balanced sections that need to be represented on the boards, but we then ask people to customize them, go with what’s meaningful to them, and have fun. First, that’s our corporate culture (we certainly take our work seriously, but our approach is generally not to take ourselves tooseriously). As a company we strive to be humble, optimistic, transparent, and be a place people enjoy working. Secondly, we want people to engage with the boards, and that’s much more likely to happen if we make them fun. We have guidelines and best practices, but we ask people to be creative within those boundaries. We want lean to work for them!

RP: What does innovation look like in an insurance company?

MC: Our lean team is part of our Digital Transformation Office (DTO). This office functions as a centralized coordinator of transformation activities. Collectively, our role in the DTO is to accelerate progress toward digital maturity and help scale solutions to benefit all of our key stakeholders: customers, company, employees and agents. Some of the current focus areas include AI, machine learning, robotic process automation, and how we will utilize data.

We have a lot of interesting work going on across the organization. We have a venture capital group, AmFam Ventures, which invests in innovative startups. Recently a company, Ring Inc., that AmFam Ventures invested in sold to Amazon for over $1 billion. We are also quite active in incubating startups, and in adding new skillsets to our organization through M&A activity.

People don’t often associate insurance companies with innovation, but this is actually a very dynamic industry. We are well positioned to compete in this environment, and be leaders in driving value for our customers. We are doing some really exciting things, taking the incremental side of innovation and the positive cultural change that has come as a result of implementing the lean management system and using it to enable our digital transformation.

THE INTERVIEWEE

Read more

FEATURE – Was Leonardo da Vinci a lean thinker? This thought-provoking article looks at his legacy, connects it to lean, and reminds us of how ahead of his time the Italian genius was.

FEATURE – How many times do we hear people say lean is not for them because “it’s a Japanese thing”? After spending 18 months in Japan, the author explains why the country’s culture is not necessarily "lean by nature".

INTERVIEW - Eric Ethington shares what he has learned about lean thinking implementations during his 30-year career holding positions at General Motors, Delphi and Textron.

INTERVIEW – From hospitals to start-ups, lean principles have been applied far beyond their origins at Toyota. This article discusses how lean can be applied to learning – specifically, how we can apply lean learning to learning lean.